Faster Activation

Instant PAMM/Copy activation reduces time-to-first-trade from weeks to hours.

Volume Multiplication

Manager trades propagate across many accounts, multiplying volume per signal.

Durable Retention

Performance + community features extend trader/IB lifespans by 2-3x.

Why Traditional Broker Stacks Stall Growth

Low activation and dormant referred accounts

Fragmented tools and manual reconciliation

No scalable mechanism to amplify trading signals

High churn and low community stickiness

Opaque attribution and rebate disputes

Heavy ops/compliance overhead (manual KYC, payouts)

One Integrated Growth Engine

IB Management, PAMM, Copy Trading, and Digital Onboarding work as a unified ecosystem-clean attribution, automated payouts, and compounding network effects.

The Compounding Flywheel

1. IBs Recruit

Partners bring investors under referral codes.

2. Instant Activation

Partners bring investors under referral codes.

3. Volume Multiplies

Partners bring investors under referral codes.

4. Retention

Partners bring investors under referral codes.

5. Organic Growth

Partners bring investors under referral codes.

ROI: Before vs After

Traditional Stack

$10,000

CAC per IB

$2,000

Monthly revenue

12 mo

Lifespan

$24,000

LTV

With FYNXT

$9,500

CAC per IB

$6,600

Monthly revenue

40 mo

Lifespan

$264,000

LTV

Implementation Impact

0-90 DAYS

Expected by day 90: +30-50% active traders, +50-100% volume uplift in pilot cohorts, 10×+ LTV:CAC trajectory in mature programs.

Days 0-14

- Environment setup

- Branding

- KYC/AML config

Days 15-30

- IB migration

- Tech integration

- Rebate rules

Days 31-60

- Automated payouts

- PAMM onboarding

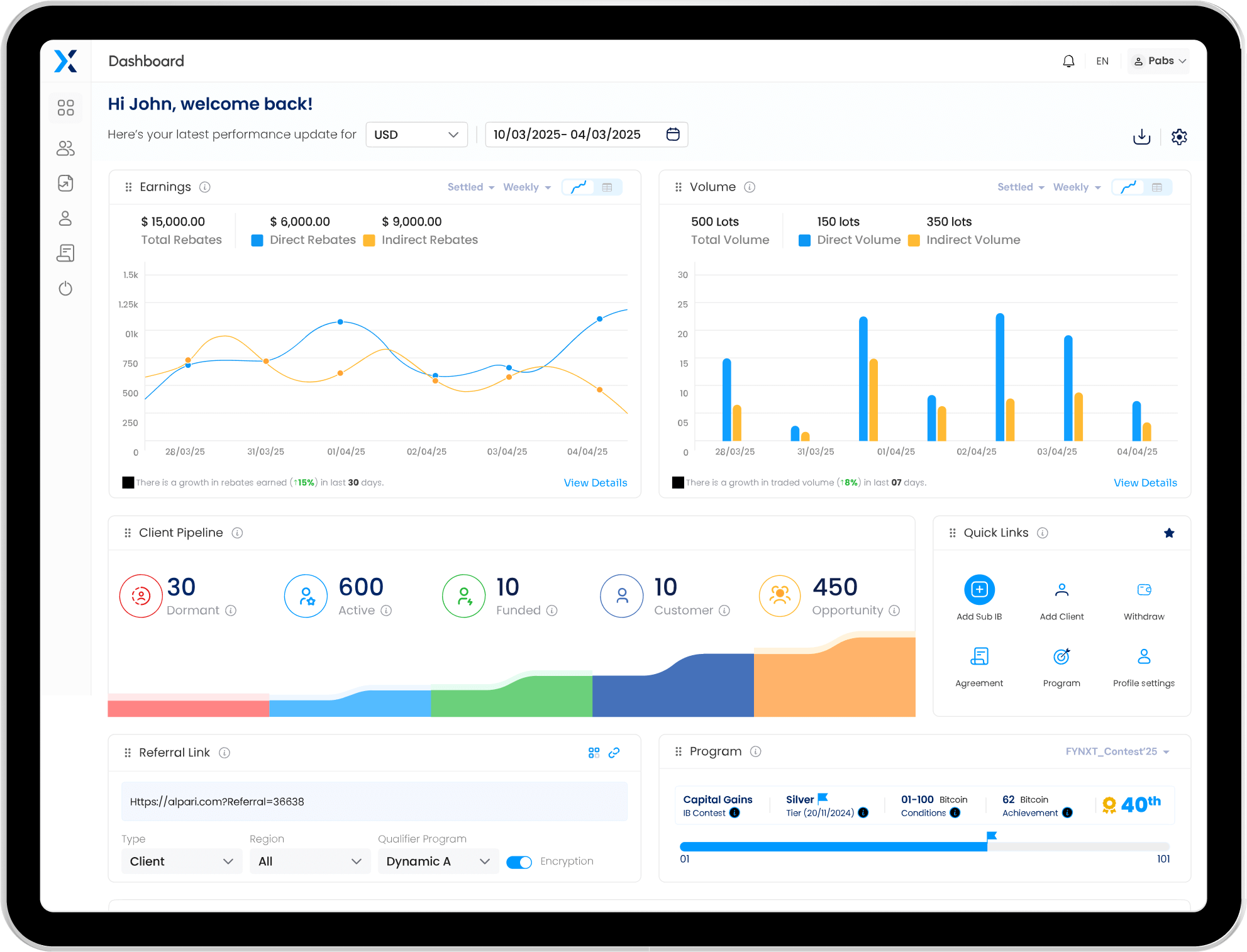

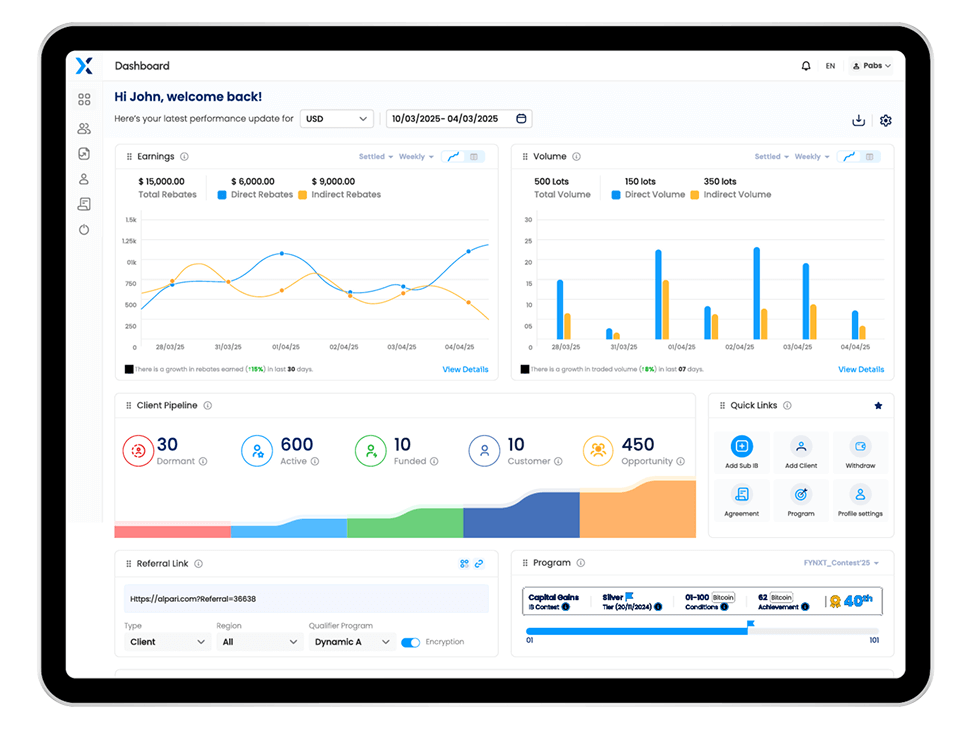

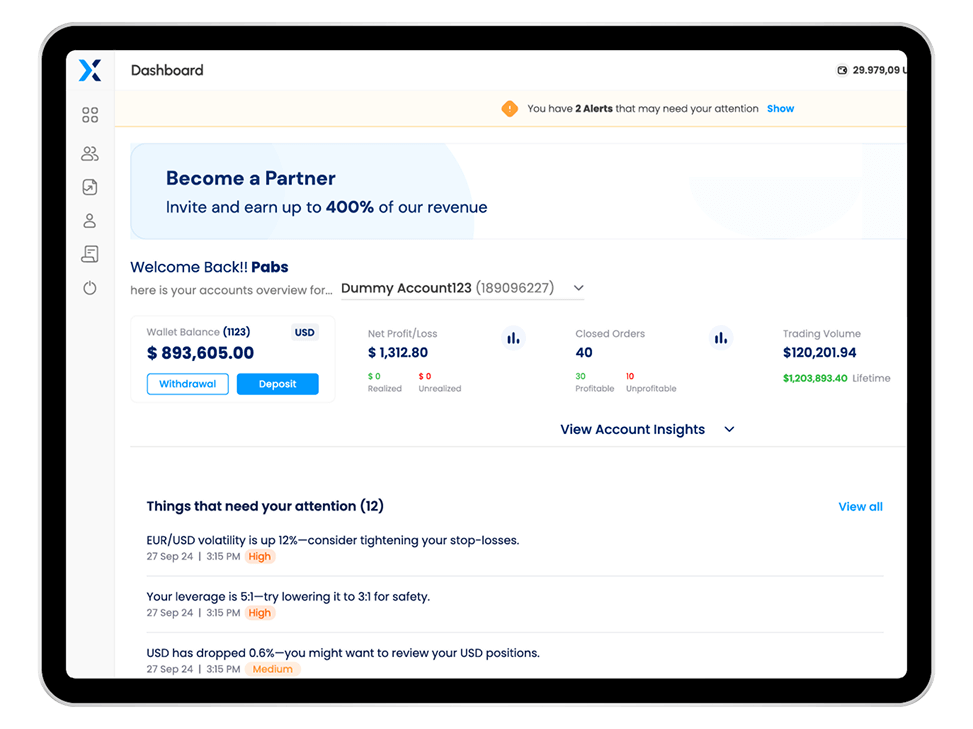

- Dashboards

Days 61-90

- Copy trading rollout

- Manager recruitment

- Pilot cohorts

5 Strategic Advantages

Network amplification: one IB activates many trading investors quickly

Compounding revenue: manager trades scale automatically

Retention flywheel: transparency + community reduce churn

Operational efficiency: automated onboarding and payouts

Unified ecosystem and clean attribution

Competitive Edge

11x

LTV gain (FYNXT)

2-3x

LTV gain (siloed)

Integrated IB + PAMM + Copy outperforms siloed tools and creates moat that compounds over time.

Beyond Growth: Operations at scale

Run a modern brokerage with enterprise-grade admin, payments, and onboarding.

Server Admin Suite

- 14 tools for MT4/MT5 ops

- 70% fewer manual tasks

- Centralized multi-server control

PSP Orchestration (Nexus)

- 100+ pre-configured PSPs

- 83% faster integrations

- Smart routing & analytics

Digital Onboarding

- Launch in ~2 weeks

- eKYC/AML + suitability

- Retail & institutional flows

Trusted Leading Financial Institutions

Ready to see your LTV:CAC jump to ~ 28:1?

Get a personalized walkthrough and ROI model using your numbers. No pressure, just clarity.

Frequently Asked Questions

Find answers to common questions about our services, support options, and how to get started with FYNXT.

FYNXT is not just a CRM—it is a full front-to-middle office platform for FX/CFD brokers. The CRM is one core module within a broader ecosystem that includes onboarding, client portal, IB Manager, Server Admin Suite, payments orchestration (Nexus), and contest management. Brokers use FYNXT to manage the entire revenue and operations lifecycle in one unified system.

Brokers can deploy core modules—Digital Onboarding, CRM, Client Portal—within 10–14 days. Full implementations with IB Manager, multi-tier structures, qualifiers, and automated payouts typically take 4–6 weeks based on scope and configuration.

Yes. FYNXT offers native, high-speed integrations with MT4, MT5, and cTrader. The integrations support real-time balance operations, bulk actions, investor account creation, trade operations, risk workflows, and audit-compliant automation.

Absolutely. FYNXT supports unlimited IB tiers, automated rebates, multi-currency payout rules, dynamic qualifiers, performance monitoring, and incentive programs. It enables partners to grow faster while reducing the broker’s manual calculation effort.

Yes. Through FYNXT Nexus, brokers can integrate with 100+ global PSPs for deposits, withdrawals, routing logic, retries, settlement preparation, and reconciliation. Nexus improves payment success rates and reduces PSP onboarding time to just a few days.

FYNXT removes the biggest operational and growth blockers, including:

- Manual, slow onboarding processes

- Fragmented CRM, IB, and client portal systems

- Limited MT4/MT5/cTrader integration flexibility

- Long go-live timelines with traditional vendors

- High operational overhead from repetitive tasks

- Manual or complex IB payout calculations

- Lack of automation for compliance and settlements